Ever heard of the term “is my shipment cleared” or “I have to get my shipment cleared as earliest as possible”? This post is all about shipment’s clearance, or otherwise formally known as Customs Clearance.

Customs Clearance is an integral part of International Trade. Without it, trade between countries is not possible. Knowing Customs Clearance helps ease the movement of your goods either inside or outside the country.

If you are involved in the movement of goods between borders, knowledge of customs clearance is necessary. Especially for Importers and Exporters. Experienced Importers and Exporters are proficient with the procedures of Customs Clearance.

In this post, we’ll define the Customs Clearance and emphasize its importance. We will then tell you about customs clearance in Pakistan Finally, we will provide you with 5 best practices for getting started with Customs Clearance win your company.

What is Customs Clearance?

Customs Clearance is a clearance, that is granted by the governing body of the country to move goods either inside or outside the country. So that means that whenever you are importing or exporting goods, irrespective of the transportation mode, you will be required to seek permission from this governing body of the country. This governing body is usually referred to as “Customs”

Customs Clearance procedure takes place whenever goods are moved in between borders, these goods can be moved in the following ways:

Sea Shipment

Air Cargo

Road Freight (Truck, Railway, etc.)

The location where the Customs Clearance takes place is usually the exit or entry points of the country. For Example

Airports

Sea Port

Dry Port

Customs Clearance is required when you move goods inside the country, that is when you Import, or when you move goods outside the country, that is when you Export. Let’s check both the scenarios individually.

Import Customs Clearance

When goods are coming inside the country, you will be required to “get it cleared from the Customs”. The Customs shall grant the clearance of your goods by assessing it against the description that you provide them and evaluating whether the rules and regulations allow the import of the assessed goods.

Majority of times, in Import, you will also be required to pay taxes, which are also known as “Duties”. Such duties differ from product to product. So, for example, if you are importing a car the duty might be 50%, however, if you are importing furniture, the duty on furniture could be 20%.

After Customs representatives are satisfied with your goods assessment, payment of duties and that your imported goods are as per the rules and regulations of the country, they will provide you with the clearance of your goods. After which you can take the goods back to your factory.

At times you might also be required to get special permission to import certain goods due to its nature.

Export Customs Clearance

Opposite to Import, Export Customs Clearance is when you want to move goods outside the country. Just like import, in Export Customs Clearance you will also be required to “get it cleared from the Customs” The Customs shall grant the clearance of your goods by assessing it against the description that you provide them and evaluating whether the rules and regulations allow the export of the assessed goods.

Even while exporting you may be required to pay for duties. You will send the goods to the exit point of your country where the Customs Official will assess your goods.

After Customs representatives are satisfied with your goods assessment, payment of duties and that your exporting goods are as per the rules and regulations of the country, they will provide you with the clearance of your goods. After which you ship the goods to your customer’s country.

Now that we know what Customs Clearance is, let’s have a look at its importance.

Why is Customs Clearance Important?

Because International trade is not possible without knowing about Customs Clearance, imagine the hurdles that you will be facing when you do not know about the procedures, rules and duties required for Customs Clearance of your goods.

Imagine your goods are stopped by Customs because you did not adhere to their rules and regulations. In the case of exporting you could lose your customer and brand reputation because of the delays caused by lack of knowledge. And in the case of importing, like raw material, you could face loss in control over your production

Customs Clearance is also important for the country. Due to Customs Clearance countries’ government can control the movement of goods. They could limit the use of certain goods, such as arms and ammunitions, to benefit their economy. Additionally, there is also a financial benefit to the national exchequer due to the duties that are paid by importers and exporters.

Likewise in the fiscal year 2017-18, Pakistan’s generate 26% of Indirect Taxes through Customs Duties only, as per data taken from State Bank of Pakistan.

Last but not the least, it is pertinent to note that Customs Clearance differs from Country to Country and not all country has the same rules and regulations when it comes to Customs Clearance.

Pakistan Example

Just like everywhere in the world, Pakistan has its Customs Clearance too. Mainly, Customs Clearance as discussed, happens on the various ports of entry and exit of Pakistan, for example, seaport, dry port and airport.

In Pakistan, the governing body is known as Pakistan Customs. They are the representative to allow import and export of your goods, collect duties on the clearance of your goods and control the contraband goods.

For more information on Duties & Taxes, you can visit FBR official Website here.

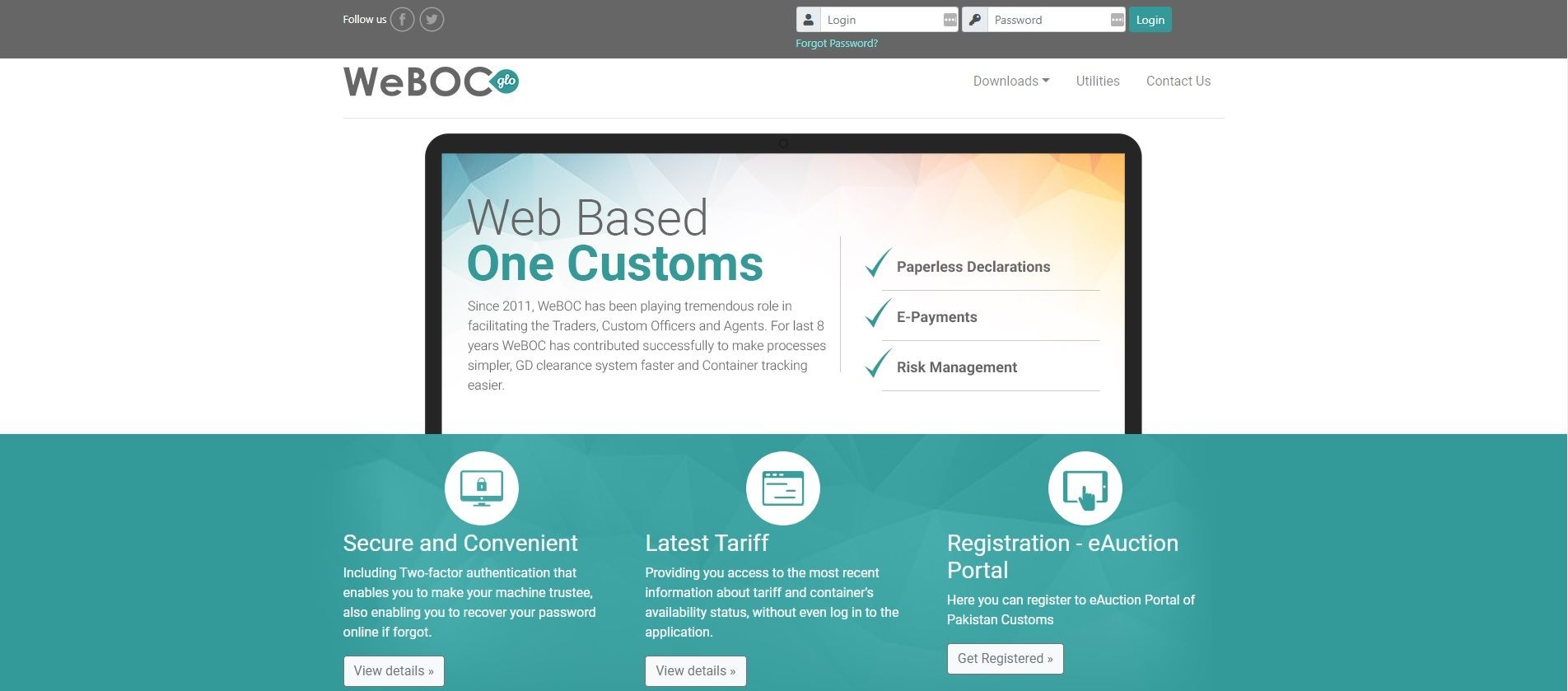

For customs clearance in Pakistan, regular importers and exporters are required to be registered on Pakistan Customs Computerized system known as “WeBOC”.

Note for Importers & Exporters

We are sure that you are familiar with Customs Clearance and its importance. Now you understand customs clearance of shipment either when you are importing goods or exporting goods.

However, we do understand that it’s difficult to get all the knowledge and experience of Customs Clearance in just a single day. Customs Clearance in Pakistan is complicated and requires experience.

Well, you shouldn’t be worried about this either, we have customs brokerages, or Customs Clearing agencies as commonly known in Pakistan, who are licensed by Pakistan Customs to clear your goods on your behalf at minimal fees.

Do you still have questions? We have been working as Customs Clearing Agency since 1981!

Join us to solve your Import & Export Customs Clearance issues right away.

What is Customs Clearance?